A “top emerging-market money manager” is reportedly “waiting for Sri Lanka to default”, as an economic crisis in the country has left Colombo struggling to keep up with international payments.

Carlos de Sousa who oversees a bond fund at Vontobel Asset management in Zurich “expects the South Asian country to run out of money to pay creditors by mid year,” according to Bloomberg.

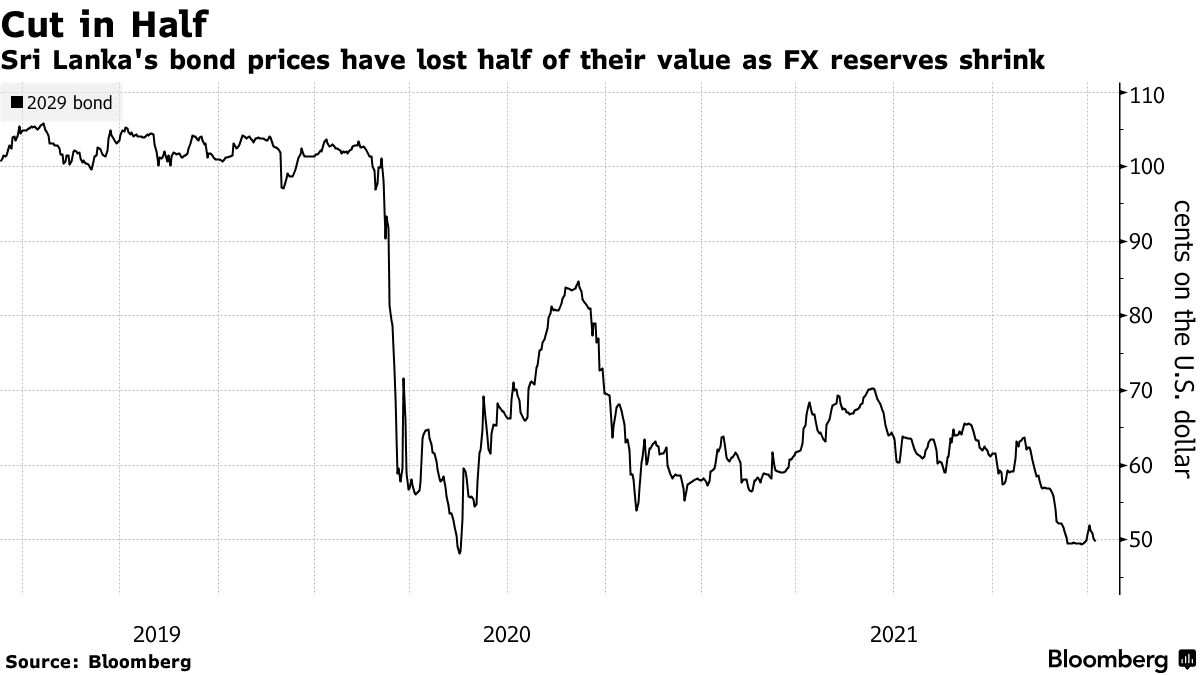

“Bonds are so cheap that the recovery value is above current prices,” de Sousa said. “The default probability is bigger than 50%.”

Sri Lanka has to repay approximately US$4.5bn in debt this year – including a US$500m international sovereign bond, which matures on 18 January.

Despite the looming payment and worsening fiscal crisis on the island, Sri Lanka’s Central Bank has claimed that it will be able to make all of its debt repayments.

Earlier this month, the World Bank reported that an estimated 500,000 people have fallen below the poverty line since the start of the pandemic and with the price of basic goods skyrocketing.