|

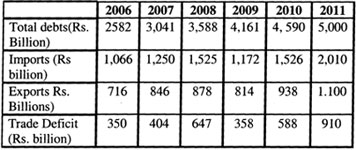

| Source Central Bank, published in The Island |

Textiles exporters hoping the fall of Sri Lanka's rupee would drive a boom this year are set to be disappointed as a resulting rise in costs of imported materials undermines margins, Reuters quoted the state-run Export Development Board (EDB) as saying Wednesday.

The rupee hit a record low of 131.60 per dollar last Monday, a drop of 14 per cent since the central bank last month opted out of an intervention method that cost it $2.7 billion in the second half of 2011.

Firms have been calling for years for a weaker currency to help them compete with other low-cost Asian producers.

But the majority of Sri Lanka’s exports like garments are based on imports.

Because of the depreciation, the cost of imports will go up and the margins on exports will come down, EDB Chairman Janaka Ratnayake told Reuters.

After garment and tea exports drove a 22 percent rise in exports last year, officials had targeted a similar gain this year that would drive exports above $13 billion.

That target was now increasingly challenging, Ratnayake said.