Sri Lanka's gold reserves have fallen to USD $92 million from USD $175 million by the end of January, as the economic crisis worsens.

Opposition parliamentarians have shone a light on the worsening economic situation within the island, highlighting the rapidly depleting gold reserves over the last month. Harsha de Silva tweeted noting that foreign currency reserves had fallen and that "further gold" had been sold for dollars in an attempt to stem the outflow of currency. Gold reserves were at a low of USD $ 92 million by the end of January, falling from USD $175 million. Last year the government sold an estimated USD $382.2 million worth of reserves, in an effort to boost the country's foreign reserves, this did not solve the crisis.

Forex reserves of #SriLanka fall to USD 2.36 bn. Sold further gold from USD 175 mn to USD 92 mm. When unusable chinese swap (RMB 10 bn or USD 1.57 bn) reduced, usable reserves are mere USD 800 mn; less than 3 weeks of imports. What now Mr @CBSL governor? Still no to @IMFNews? pic.twitter.com/ZCLu9ey7IV

— Harsha de Silva (@HarshadeSilvaMP) February 7, 2022

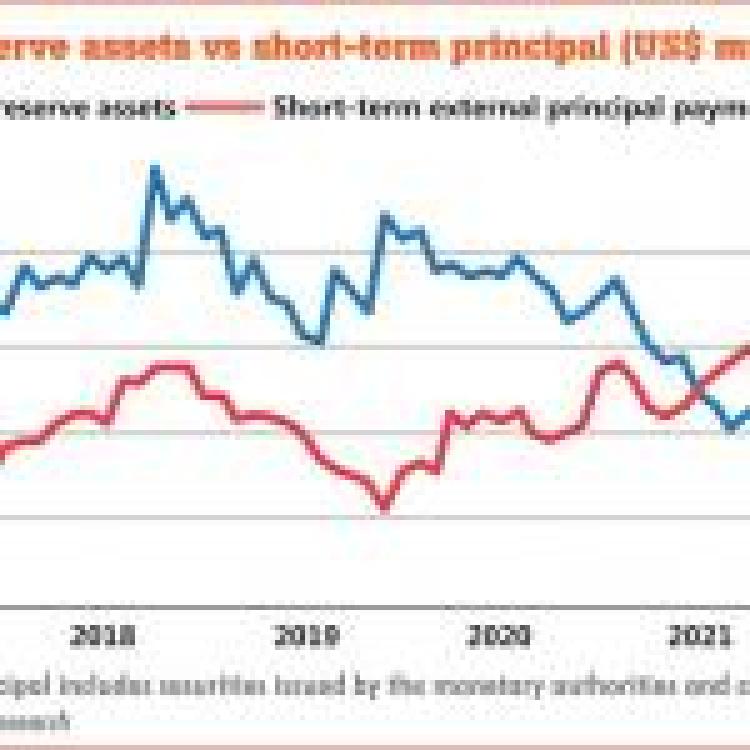

Sri Lanka's foreign currency reserves have fallen over 24% to USD $2.36 billion by the end of January from USD $3.14 billion at the end of December 2021, despite currency swaps and debt deferments from India and China.

The January foreign reserves only provide 1.4 months worth of import cover. However, critics have pointed out that the actual number to be at USD $800 million of useable reserves, roughly 3 weeks worth of imports. The USD $2.36 billion includes the Chinese swap of 10 billion yuan, which equals roughly USD $1.5 billion. The holding of yuan although bolstering the nation's reserves is not being used to finance vital imports or settle debt repayments as the country spirals into a deepening economic crisis. As the island nation battles with rising inflation, essential good items have reached record highs restricting vulnerable households access to food.

In the three months from February to April, Sri Lanka has another USD $ 1.83 billion foreign currency debt settlements to pay, while a USD $1 billion dollar sovereign bond matures in July. The country faces an increased risk of default, yet so far has resisted and shut down any inclination that it will seek assistance from the IMF to restructure its debt. The country instead is banking on that it can access more bilateral and multilateral funding lines. As the livelihood of those across the island becomes more precarious the militarised state, still finds foreign reserves to purchase military aircraft from India.

Read more here.