In advance of the Moody Investor Service placing Sri Lanka “under review for downgrade” Sri Lanka’s Ministry of Finance slammed the agency’s announcement claiming that it was “ill-timed, ill-judged and hence unacceptable’.

Recovering from the pandemic

The statement comes as Sri Lanka’s continues to grapple with its third wave of COVID-19, with a reported 3,218 deaths due to COVID in just the past three months. Regions like Colombo and Gampaha have seen case numbers as high as 66,400 and 51,110 respectively.

In their statement, the Ministry of Finance claimed a successful vaccination drive and that there was a strong potential for a “rebound of the tourism sector” however the government has faced sharp criticism from human rights organisations such as Amnesty International for its discriminatory policies in response to the pandemic.

In their reporting, Amnesty International slams Sri Lanka’s handling of the coronavirus pandemic highlighting the gag order on the health care sector; the prioritisation of those with economic or political privilege at the expense of at-risk groups; the abuse of factory workers and prisoners; as well as the lack of a comprehensive plan to vaccinate the whole population.

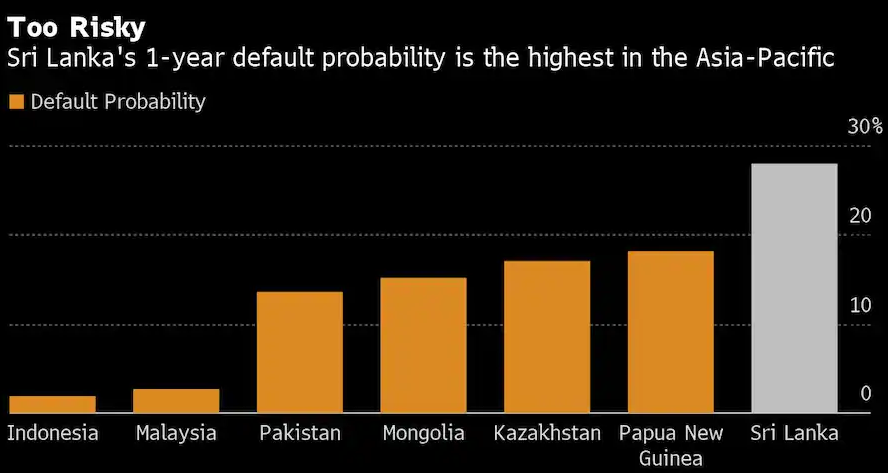

Earlier this month, Bloomberg reported that Sri Lanka’s default probability was the highest in Asia with the organisation estimating a 27.9% chance of one-year default. The Washington Post notes that “a reading above 1.5% signifies high risk of failure to pay”.

Investment doubts

The Ministry of Finance disputes this reporting claiming that it has taken all “measures to repay ISB (International sovereign Bond) maturity of US dollars 1,000 million in end July 2021”. The Ministry further adds that “ongoing developments in the domestic production economy are expected to improve the country’s export potential”.

This comes however as Sri Lanka faces the risk of losing its GSP+ status with the European Union parliament passing a resolution last month criticising Sri Lanka for its deteriorating human rights situations and continuation of its draconian Prevention of Terrorism Act.

The loss of the GSP+ trading arrangement would have a significant impact on the country's economy as 20% of Sri Lanka's total exports are to EU countries. A further 10% are to the United Kingdom which may follow the EU's lead, warns Sri Lankan economist Sirimal Abeyratne, professor of economics at the University of Colombo.

Bloomberg reports that Sri Lanka’s “first test comes July 27, when the South Asian nation must repay a $1 billion bond to investors”. Sri Lanka owes at least $2.5 billion in debt over the next 12 months.

Read the Ministry of Finance’s full statement here.