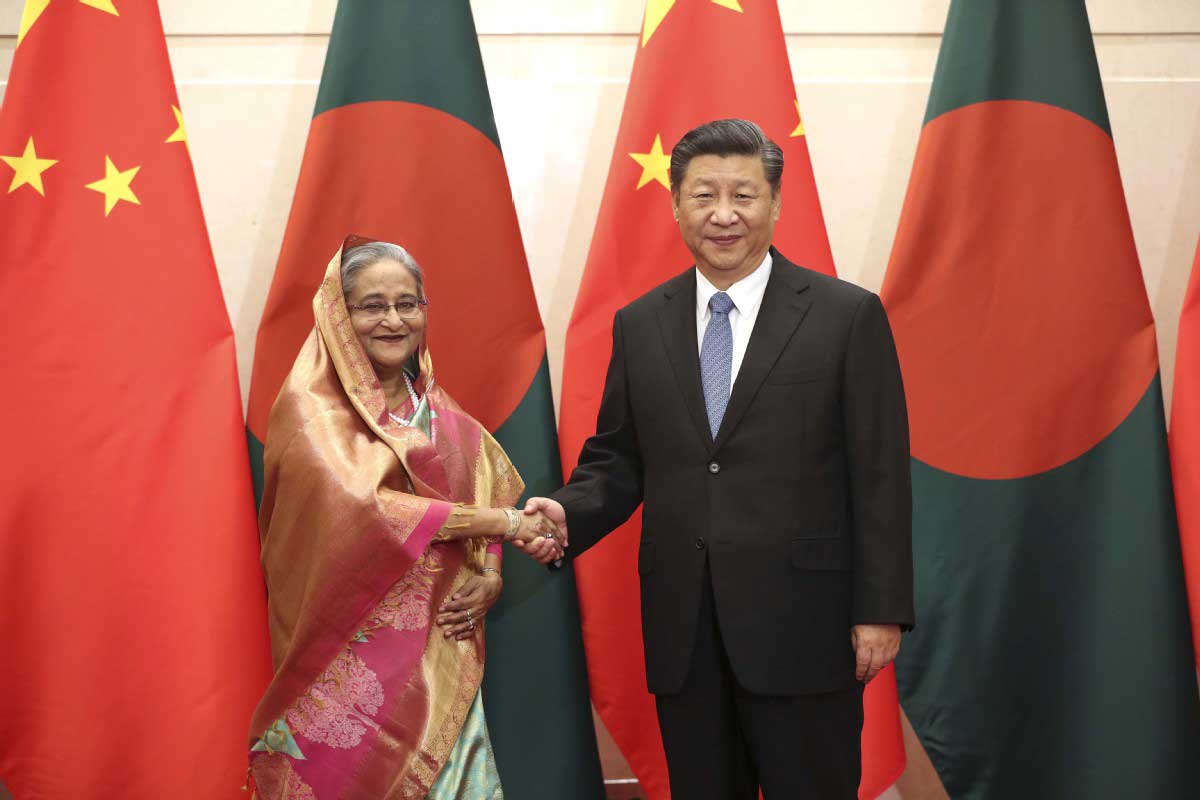

Photo by Feng Yongbin - China Daily

As Sri Lanka continues to grapple with the ongoing COVID pandemic, the country turns to China and Bangladesh for financial assistance and has become the first country in Asia to raise interest rates since the pandemic began.

The move to increase interest rates follows a spike in inflation over food prices and shortages. In the past month consumer price-based inflation rose 5.7% compared with June's 5.2%, latest data showed. At the same time, the country’s currency has depreciated 8% this year.

In responding to this financial crisis, Sri Lanka’s Central Bank has increased its standing deposit facility rate and the standing lending facility rate by 50 basis points each to 5% and 6%, respectively. Sri Lanka’s Central Bank has also increased the statutory reserve ratio by 200 basis points to 4% with effect from Sept. 1.

The government has further secured an agreement with the Central Bank of Bangladesh for a loan of $50 million dollars as part of a $250 million dollar currency swap. China’s Development Bank has approved a term facility agreement with Sri Lanka worth RMB 2 billion, approximately Rs. 61.5 billion. The move is intended to boost Sri Lanka’s cratering foreign reserves and ease pressure on exchange rates.

The move follows a refusal to turn to the US-backed International Monetary Fund.

Refusal to engage with the IMF

At the start of this year, Sri Lanka’s Central Bank Governor, Weligamage Don Lakshman, rejected the possibility of turning to the IMF for support stating:

“It is the government policy to work as much as possible to resolve our foreign exchange policies on a self-reliant basis and to hold discussions with institutions and organizations and countries which are willing to assist on a relatively non-interventionist basis.”

He maintained that the government’s policy would rule out support from the IMF as the government would increase spending to support the economy. The IMF’s prescriptions which include fiscal consolidation and removing caps on borrowing costs would run contrary to Sri Lanka's ambitions.

The risk of default

However, Sri Lanka’s continued borrowing leaves the country at risk of defaulting on payments. The latest loan from the Central Bank of Bangladesh has been agreed for three months with the expectation that the Central Bank of Sri Lanka will repay the debt with an interest rate of London Interbank Offered Rate (Libor) plus 2%. If the loan cannot be repaid the tenure will be extended to six months and the interest rate will be increased to include the Libor and 2.5%.

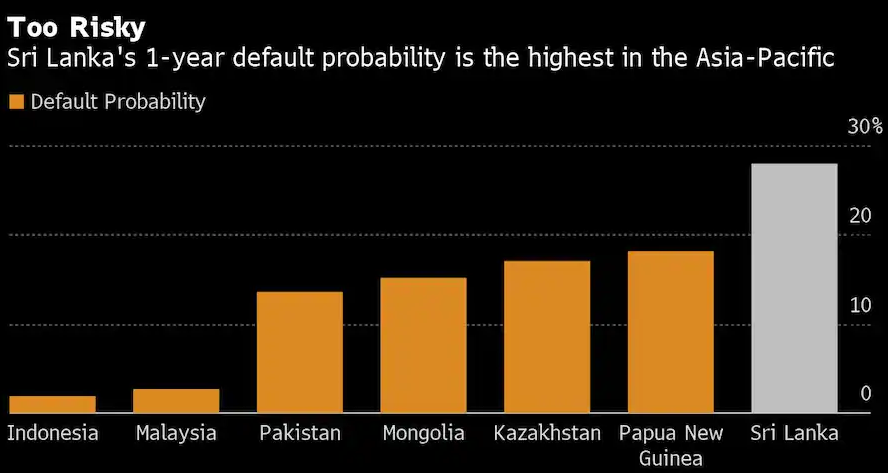

Earlier this year, a Bloomberg model maintained that Sri Lanka’s default probability was the highest in Asia with the organisation estimating a 27.9% chance of one-year default.

Whilst Sri Lanka has succeeded in paying of its $1 billion bond to investors, Tamil parliamentarian CV Wigneswaran warned that the country erred towards a financial default which would “trigger cross-defaults across all our loans”.

Sri Lanka must repay at least $3.7 billion in debt this year.

Trisha Peries, head economist research at Frontier Research, has told Reuters that despite the government’s reluctance:

"We think it's likely that there could be around one more rate hike before the end of the year, particularly if it looks like we are moving towards an IMF programme, along with what is expected to be a tighter budget announced for 2022,"