Fitch Ratings has affirmed Sri Lanka's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'RD' (Restricted Default) and its Long-Term Local-Currency IDR at 'CCC', citing concerns that the recent election of Anura Dissanayake as president, adds "uncertainty to the country’s policy direction".

The ratings agency highlighted that this uncertainty could delay the completion of foreign-currency debt restructuring or the renegotiation of the country’s International Monetary Fund (IMF) programme. Fitch pointed to the upcoming 2025 budget, expected to be adopted by November 2024, as a potential indicator of the new government's policy direction. However, the agency warned that weak implementation of the IMF programme, particularly in terms of fiscal measures, remains a significant risk to achieving long-term debt sustainability.

Although Sri Lanka has historically struggled to raise revenue, authorities have introduced several major tax reforms since May 2022 in a bid to improve revenue collection and address the country’s mounting debt crisis. These reforms include raising the corporate income tax rate, increasing the value-added tax, and hiking fuel excise taxes. As a result, revenue collection improved by 42% year-on-year in the first half of 2024.

Despite these efforts, Fitch expressed concern over the potential for policy shifts under the new administration, which could affect the timeline and success of both debt restructuring and IMF negotiations. The country remains under close scrutiny as it navigates its way through an ongoing economic crisis.

Fitch's move reflects concerns over the country’s ability to stabilize its economy and navigate its substantial debt obligations amid ongoing political upheaval.

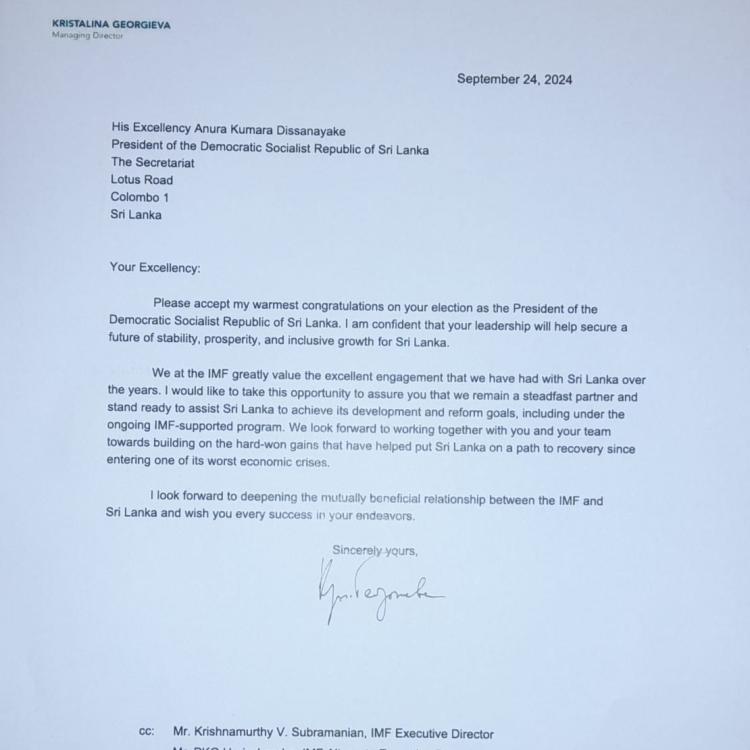

In a televised address Dissanayake has said he plans to immediately begin talks with the International Monetary Fund (IMF) to advance the country’s $2.9 billion bailout program. “Additionally, to advance our debt restructuring program, we are negotiating with relevant creditors to expedite the process and secure necessary debt relief,” Dissanayake stated.

Sri Lanka's dollar bonds and stocks sharply initially declined following the election of Dissanayake as president, with global uncertainty over what his rule would bring.