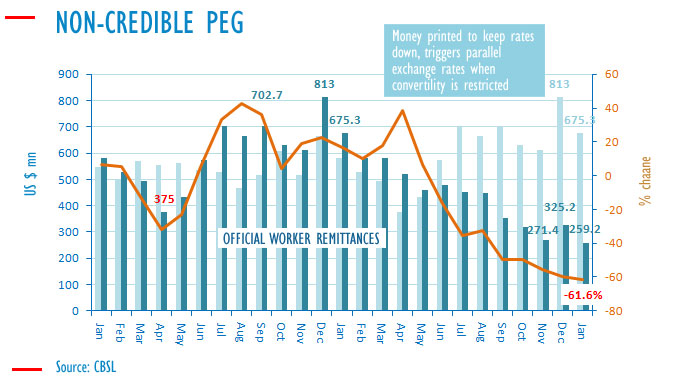

Sri Lanka's official remittances in January 2022 were down 61.6 per cent from a year earlier, as overseas workers sent money through unofficial channels at higher parallel exchange rates.

Sri Lanka's remittances dropped to USD $259.2 million, more than a 60 per cent decrease from January 2021 levels. Sri Lanka is trying to enforce a peg at 200 LKR to the US dollar, however monetary policy from the Central Bank of Sri Lanka has resulted in money printing and subsequent liquidity injections which have pushed the price in the unofficial markets to around 248 LKR to the US dollar, and others not associated with the banking system, even higher.

In response, government authorities are offering 10 LKR above the official 200 to the US dollar rate, where at least 8 rupees is coming from the central bank itself. However, the increased liquidity expands reserve money which in turn triggers more pressure on the peg undermining its credibility further.

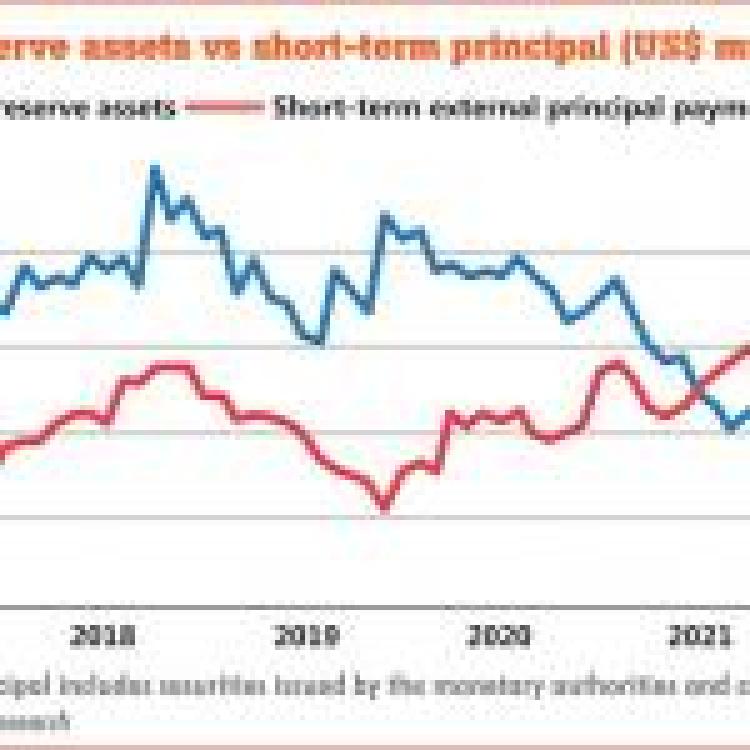

Sri Lanka faces an acute forex crisis that has impacted all sectors across the economy. Food, medicine and oil shortages have been reported as the country lacks US dollars to purchase vital imports. As a result of this widespread power outages have been reported across the South of the island and the city hub. Last year Sri Lanka was forced to close three of its diplomatic posts in Nigeria, Germany and Cyprus in a bid to conserve foreign currency reserves. The economic crisis in Sri Lanka is also coupled with high levels of inflation which have pushed up the prices of everyday items to record levels. As the government continues to waiver any sign of seeking an IMF bailout, January foreign reserve levels only provide 1.4 months' worth of import cover. However, critics have pointed out that the actual number to be at USD $800 million of useable reserves, roughly 3 weeks' worth of imports. The USD $2.36 billion includes the Chinese swap of 10 billion yuan, which equals roughly USD $1.5 billion. The holding of yuan although bolstering the nation's reserves is not being used to finance vital imports or settle debt repayments as the country spirals into a deepening economic crisis.

Read more at EconomyNext.